Contents:

It is diffehttps://1investing.in/ from the average variable cost, which remains the same, even when there is a change in the quantity of the goods produced by the company. Average total cost is referred to as the sum total of all production costs divided by the total quantity of output. In other words, the average cost is the combination of total fixed and variable costs, which is divided by the total number of units that are produced by the firm. Watch this clip as a continuation from the video on the previous page to see how average variable cost, average fixed costs, and average total costs are calculated. There are two ways to calculate the average fixed cost in the company, i.e., either by dividing the total fixed cost by the total output or by subtracting the company’s average variable cost from the company’s average total cost. Long-run average total cost is a business metric that represents the average cost per unit of output over the long run, where all inputs are considered to be variable and the scale of production is changeable.

ABB FIA Formula E World Championship comes to desert for night … – Daijiworld.com

ABB FIA Formula E World Championship comes to desert for night ….

Posted: Thu, 26 Jan 2023 08:00:00 GMT [source]

The PDD will give the average daily amount of a drug that is actually prescribed. When there is a substantial discrepancy between the PDD and the DDD, it is important to take this into consideration when evaluating and interpreting drug utilization figures. DDDs sometimes need to be reviewed because dosages may change over time, e.g. due to the introduction of new main indications or new research making it necessary to change the DDD. The AFC curve trends downward because since it is fixed, it’s just being divided by a larger quantity every additional good, thus getting smaller.

Example of Long-Run Average Total Cost

The amount of money spent by the sales department on selling a product is referred to as selling expenses. This includes expenses incurred on advertising, distribution and marketing. Because it is indirectly related to the production and delivery of goods and services, it is classified as an indirect cost. Selling ExpenseThe amount of money spent by the sales department on selling a product is referred to as selling expenses. Similar to the previous cases, let’s start by calculating the total variable cost. With the increase in the company’s production, the AFC of the company falls, and the curve of the AFC will slope downwards continuously, from left to right.

BJP MPs Nishikant Dubey, Manoj Tiwari among 9 booked for forcing entry into ATC – The Indian Express

BJP MPs Nishikant Dubey, Manoj Tiwari among 9 booked for forcing entry into ATC.

Posted: Sat, 03 Sep 2022 07:00:00 GMT [source]

Now, the quantity of units that has been produced has to be determined. This theory states that after a certain level, adding an additional factor of production is going to result in a smaller increase in output. And because of that, the ATC curve is shaped like the letter “U”. When there is a decrease in the company’s production, then the company’s AFC increases. To give an example, let’s say you own an Italian restaurant, called Best Pizza.

Long-term unit costs are almost always less than short-term unit costs because, in a long-term time frame, companies have the flexibility to change big components of their operations, such as factories, to achieve optimal efficiency. A goal of both company management and investors is to determine the lower bounds of LRATC. Examples Of Fixed CostsFixed cost are the costs which are not directly related to production or manufacturing or operating activity of a business. Examples of which include rent payable, salaries payable, interest expenses and other utilities payable. Fixed CostsFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity.

Examples of ATC Financial Statements in a sentence

This includes fixed costs, those costs that are required for production but do not change based on output, and variable costs, those costs that increase as output increases . Any price below average total cost will result in a financial loss. It is evident from the graph above that the average total cost curve initially falls, bottoms out around 18 units and then rises. It falls because as the output increase, the fixed cost is spread over more and more units.

From there, you can clearly see how the average total cost changes with the change in production level. Now, let’s calculate the average total cost for the second case, i.e for 600 units of LED bulb production. It is different from the average variable cost, as AFC changes whenever there is a change in the quantity of the goods produced by the company. Still, in the case of the average variable cost, it remains the same even when there is a change in the quantity of the goods produced by the company. If the market price that a perfectly competitive firm receives leads it to produce at a quantity where the price is greater than average cost, the firm will earn profits. If the price the firm receives causes it to produce at a quantity where price equals average cost, which occurs at the minimum point of the AC curve, then the firm earns zero profits.

Which intersection should a firm choose?

When there is an increase in the company’s production, then the AFC of the company falls. So, there is the advantage of the increase in the output, and the profit of the company, in that case, will be more. Note that while total quantity usually has the abbreviation of a capital Q, it sometimes appears as a lowercase q. This might happen in problems or models where the goal is to emphasize the fact that the company is small.

If the company continues to scale up production, it will reach the part of the curve where diseconomies of scale become a factor and costs rise. Though a company might streamline operations, it might see new layers of bureaucracy and management introduced, which can slow overall production and decision making. The more the operation grows at this stage, the costs will rise as the operation loses efficiency.

Thus, the firm is losing money and the loss will be the rose-shaded rectangle. In the computer monitor example, let’s set our fixed costs of the monthly lease payment for the equipment and building at $50,000. For purposes of comparing how average total cost can change based on production, let’s set output at 4,000 in July and 6,000 in August. The average total cost refers to the total costs incurred in the production of a product or a good divided by the total number of units produced. It is also referred to as the breakeven price, which is the minimum possible price that if used, the company will make no financial losses nor gains.

Five ways the state can help downtown – Indianapolis Business … – Indianapolis Business Journal

Five ways the state can help downtown – Indianapolis Business ….

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

The long-run cash and cash equivalents cost curve shows the lowest total cost to produce a given level of output in the long run. When economists, production managers, or others refer to average total cost, they are referring to the per unit cost that includes all fixed costs and all variable costs. Knowing average total cost is critical in making pricing decisions, as any price below average total cost will result in a financial loss. In economics, average total cost equals total fixed and variable costs divided by total units produced.

Fixed costs are costs that do not vary with the amount of output produced by the company and are independent of the number of goods or services produced by the business. Finally, find out the average total cost by dividing the total cost by the quantity of produced LED light bulbs. The marginal cost curve may fall for the first few units of output but after that are generally upward-sloping, because diminishing marginal returns implies that additional units are more costly to produce. A small range of increasing marginal returns can be seen in the figure as a dip in the marginal cost curve before it starts rising.

For reading more of such interesting concepts on Economics for Class 12, stay tuned to BYJU’S. Sometimes the fixed cost is confused with the average fixed cost by the user of the value, which may not fulfill the purpose of the analysis. Read The Supply Curve article to get a more detailed explaination of why this is so.

Meanwhile, you also have to buy ingredients to make pizza (flour, water, cheese, etc.). For the sake of this example, we’ll assume that the ingredients needed for one pizza cost exactly USD 2.00 and there are no other fixed costs than the rent you pay. Thus, if you plan to sell 1,000 pizzas, your variable costs will add up to USD 2,000 and total cost is USD 4,500 (i.e. 2,500 + 2,000). Price and Average Cost at the Raspberry Farm.In , price intersects marginal cost above the average cost curve.

- Watch this clip as a continuation from the video on the previous page to see how average variable cost, average fixed costs, and average total costs are calculated.

- Because it is indirectly related to the production and delivery of goods and services, it is classified as an indirect cost.

- Now, let’s calculate the ATC for the final case, i.e for manufacturing 800 units of the LED light bulbs.

- The average total cost is the total costs divided by the total quantity produced.

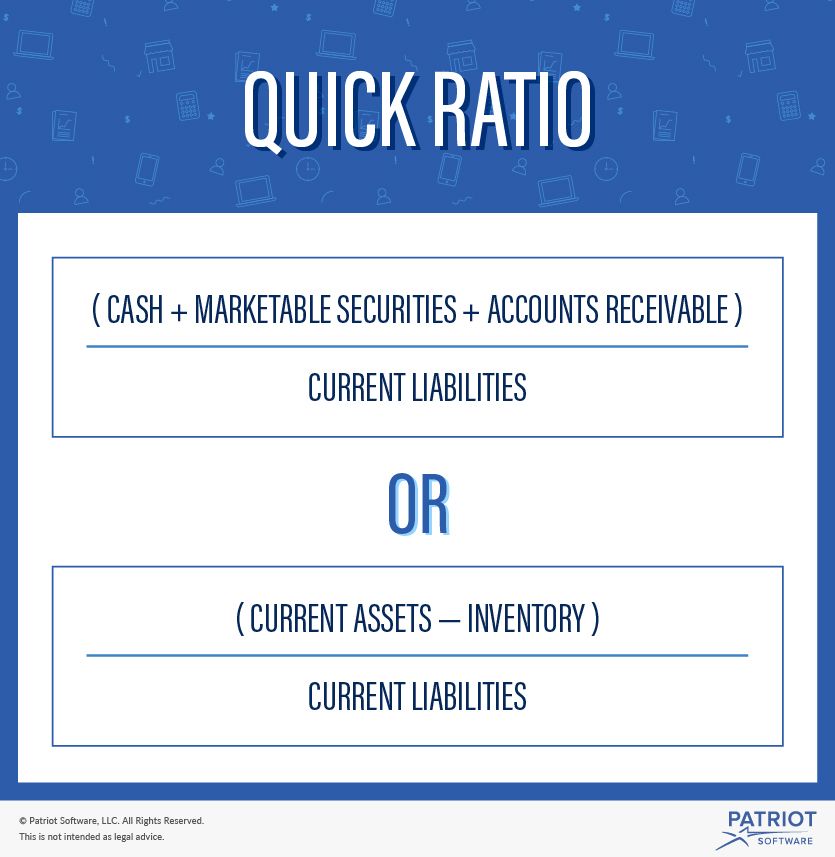

This formula shows how much a firm has to spend on each unit of output it manufactures. It shows that average total cost is the sum of average variable cost and average fixed cost. In this formula, the total cost includes all the costs that are necessary to produce the goods. That means, the total cost includes both the variable cost and the fixed cost (a one-time cost that doesn’t change with the output and is necessary to manufacture the products).

Finally, if the price the firm receives leads it to produce at a quantity where the price is less than average cost, the firm will earn losses. The Average Total Cost formula computes the Unit Cost or Average Total Cost which is equal to the sum of the fixed and variable costs divided by the number of goods produced . In cases where the average total cost breaches the permissible limit, then the production manager should either halt the incremental production or try to negotiate the variable cost. In this case, it can be seen that the average total cost decreases with the increase in the production quantity, which is the major inference from the above cost analysis. Average Fixed CostAverage Fixed Cost refers to the company’s fixed production expenses per unit of goods produced.

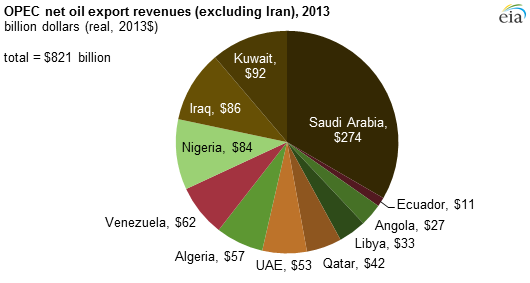

The first five columns of Table 1 should look familiar—they come from the Clip Joint example we saw earlier—but there are also three new columns showing average total costs, average variable costs, and marginal costs. We have also plotted average fixed cost and average variable cost curves so we can see what is ultimately driving the average total cost curve. The following chart shows the change in average total cost, average fixed cost, and average variable cost of production with respect to the change in production quantity.